Generally, under Swiss law, card acquiring is currently not considered a regulated financial activity. It does not require a license from the Swiss Financial Market Supervisory Authority (FINMA), nor does it require affiliation with a Self-Regulatory Organisation (SRO) under the Anti-Money Laundering Act (SRO Membership). In other words, acquiring is, at present, an unregulated activity in Switzerland — in contrast with the regulatory framework adopted in the EU. FINMA considers that the primary AML risk lies in the issuing activity, not acquiring.

Despite this legal classification, the situation in practice is more nuanced. Acquirers frequently delegate key tasks—such as merchant onboarding or fund settlement—to third parties, commonly referred to as PayFac. In such models, the licensed acquirer retains full responsibility and must ensure that the outsourced entities comply with both card scheme rules and applicable legal obligations.

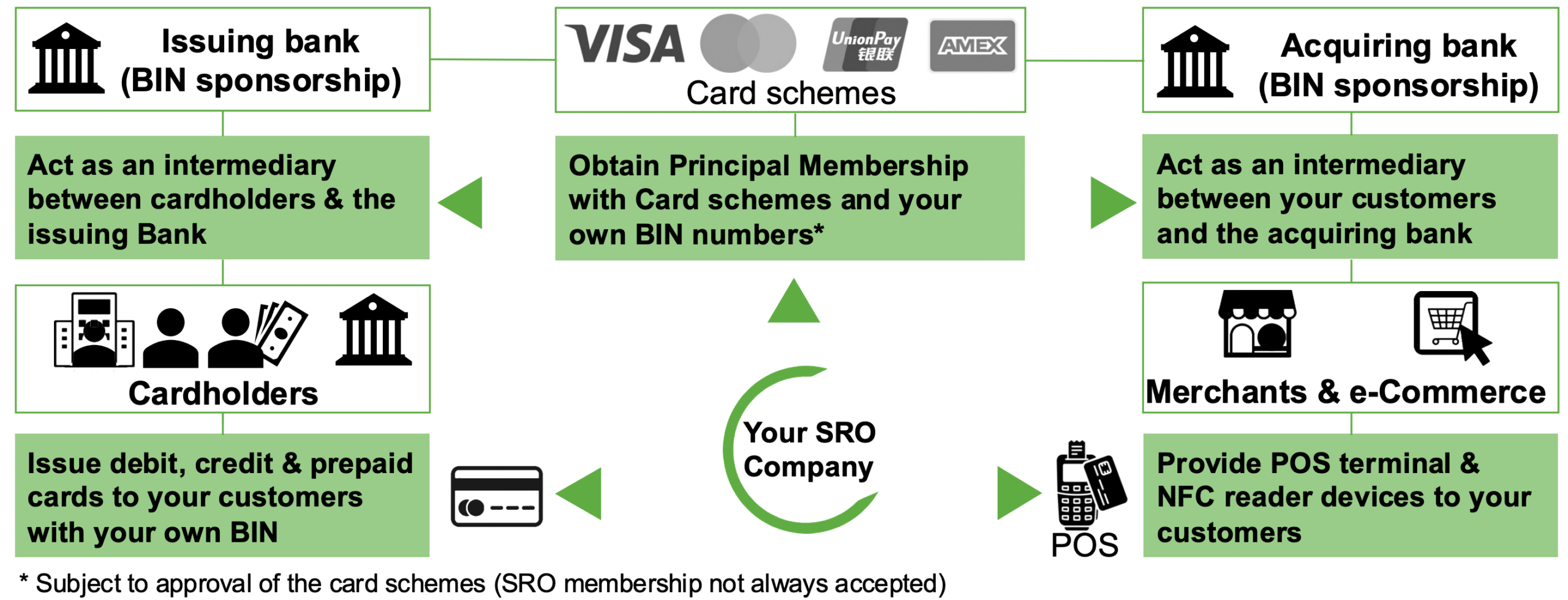

Moreover, although acquiring is legally unregulated, Swiss and international partner banks often expect acquirers to be under some form of regulatory oversight. Consequently, most acquirers aiming to collaborate with Swiss banks or global card schemes will find that SRO affiliation becomes practically necessary to meet institutional compliance and risk standards.

If the acquirer expands its services to include currency conversion, fund collection (i.e., accepting deposits from the public), or other forms of payment processing on behalf of merchants, the activity falls within the scope of financial intermediation under Swiss AML legislation. In such cases, SRO membership is no longer optional but becomes mandatory. The same applies to any arrangement involving the holding or forwarding of client funds in a commercial context.

Although SRO membership is typically a de facto prerequisite for applying for principal membership with Visa or Mastercard, it does not guarantee acceptance by the card schemes.

Visa and Mastercard retain significant discretion in approving new members and assigning BIN numbers. Their decision depends on a combination of factors, such as:

Projected transaction volumes

Business model viability and internal risk controls

Compliance history and geographic focus

Alignment with the scheme’s internal risk policies

In practice, Visa and Mastercard generally require at least an SRO membership for principal membership applications, but such affiliation does not automatically entitle an applicant to scheme onboarding. Other elements—such as strategic fit, due diligence outcomes, and risk profile—are critically assessed.

Therefore, while an SRO Membership is a prerequisite, obtaining a BIN and principal membership requires a comprehensive approach that balances regulatory alignment with commercial credibility.

At SynHedge, we help acquiring institutions and fintechs navigate the complex regulatory and commercial environment in Switzerland. Whether you're establishing a new acquiring structure, applying for SRO membership, or preparing for principal membership with Visa or Mastercard, we offer tailored legal and strategic support—ensuring full regulatory readiness and optimizing your chances of successful onboarding with scheme partners and banks.

Copyright © SynHedge LLC - 2026

Copyright © SynHedge LLC - 2026