At least two local executive directors and three board members. One-third of the board of directors must be independent from the management.

Switzerland does not have an Electronic Money Institution (EMI) license equivalent to those issued under the EU's PSD2 framework or the UK's E-Money Regulations (EMRs). In fact, Swiss financial regulation does not legally recognise the concept of “electronic money” as defined in the EU or UK.

However, since 2019, Switzerland has introduced a regulatory framework known as the FinTech license (also referred to as the Swiss "banking light" license), which is governed by the Swiss Banking Act (BankG). While not identical to an EMI license, the FinTech license offers several similar features. It allows licensed institutions to accept public deposits up to CHF 100 million without engaging in traditional lending activities. It also enables them to offer client accounts with their own IBANs, making it suitable for payment institutions, digital banks, and other innovative financial service providers.

This regulatory approach provides a flexible and innovation-friendly environment for fintech companies looking to operate in Switzerland without the full burden of a traditional banking license.

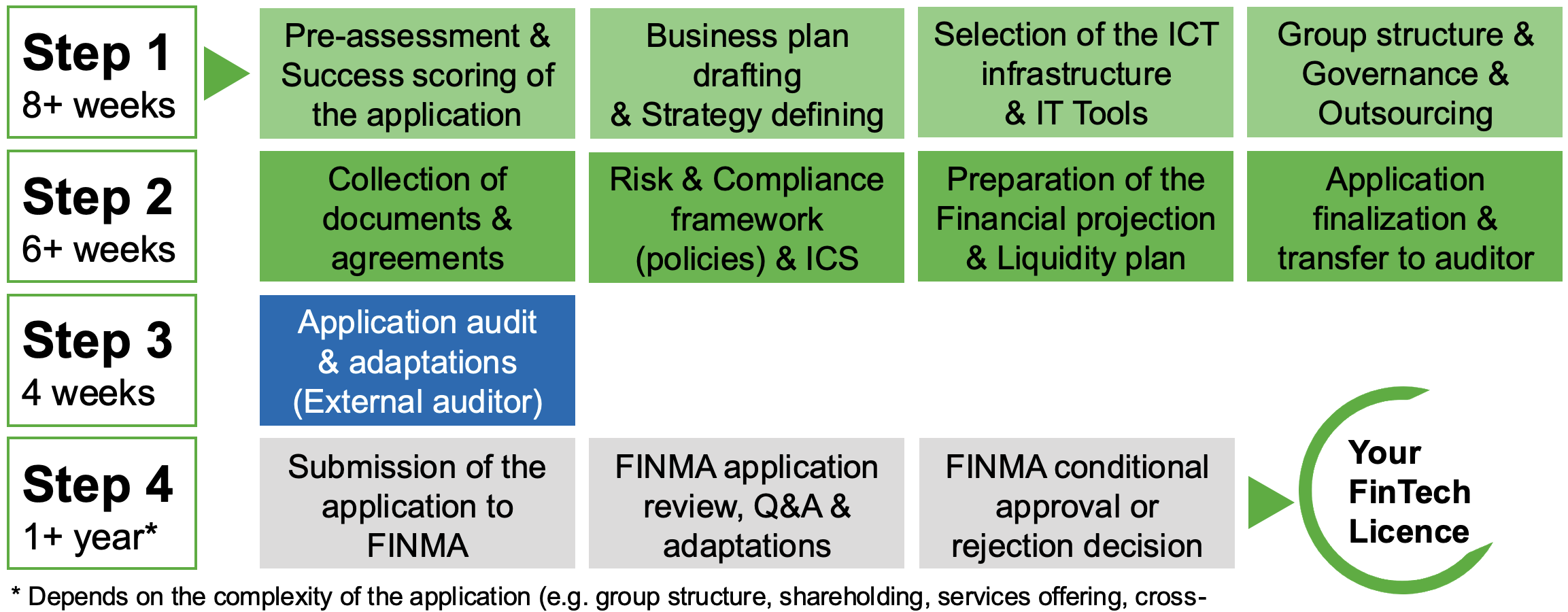

The process of obtaining a fintech license unfolds in 4 main phases.

Step 1 - Business plan:

Once your company is incorporated in Switzerland, the first step is to establish a solid business plan. This includes regulatory assessments of the planned activities, as well as the selection of IT tools and infrastructure (e.g., outsourcing, core banking systems, KYC tools, etc.).

Step 2 - Formal Application Process:

During this phase, we collect the personal documents of the directors, board members, and external service providers. We then establish the compliance and risk framework, which includes creating several policies, a risk register, etc. We base our approach on ISO 31000. Finally, financial projections are prepared, including three different scenarios.

Step 3 - External Audit:

Once all the documents are reviewed and collected, we submit the application to an external auditor who evaluates the entire application and prepares a report for FINMA. The audit must be conducted by an approved auditor (Art. 1b BankA).

Step 4 - FINMA Review & Decision:

Once the audit is successfully passed, we submit the application to FINMA, who will review it and may ask additional questions. Finally, FINMA will issue the authorization if all conditions are met. This is often a conditional authorization at first, allowing the applicant to address any specific conditions (such as a change of address or modification of the statutes). Once the conditions are fulfilled and FINMA gives its final approval, the applicant can activate the license and begin operations.

The duration of the fintech license application process with FINMA depends on several factors, including the business plan, the risks associated with the company, the compliance framework, whether consolidated supervision applies, and the responsiveness of the applicant. In practice, obtaining a fintech license now takes longer than it did initially, particularly due to the bankruptcy of two fintech companies (Mogeli & Swiss 4.0). As a result, FINMA has become more stringent in its financial and business plan assessments. To give an estimate, the process generally takes between one and two years.

In general, a fintech company must have at least:

Finally, it is crucial for the company to have robust risk and compliance frameworks in place.

Yes. Unlike under MiCA regulations in the EU, USDT is not prohibited in Switzerland and can be freely used and offered to clients without issue.

As a company based in Switzerland and regulated under Swiss law, MiCA (Markets in Crypto-Assets Regulation) is not directly applicable. However, MiCA may become relevant if you provide cross-border crypto services targeting clients in the European Union. In such cases, Swiss companies must carefully assess whether their activities fall within the scope of MiCA and whether local compliance requirements (such as reverse solicitation exemptions or licensing needs) apply.

No, since Switzerland is not part of the European Union, EU passporting is not available to Swiss-licensed entities. However, this does not mean that cross-border activities are prohibited. Swiss companies may still serve EU-based clients, but must carefully assess the legal and regulatory requirements in each relevant EU member state, particularly when actively soliciting clients or offering services in the EU.

Yes, a fintech licence allows for the combination of crypto and payment activities under the same entity. This is one of the advantages, as it effectively combines the roles of a PSP (Payment Service Provider) and a VASP (Virtual Asset Service Provider) within the same company.

The capital requirement for a fintech license is set at CHF 300,000 (fully paid). However, in practice, FINMA will require the company to have sufficient liquidity to cover all operational expenses for the next 12 months, based on a worst-case scenario. Generally, with a minimum structure, this leads to a capital of approximately CHF 1 million, although this depends on the company’s specific costs.

As of April 4, 2025, there are only 4 companies active with a fintech license (1b bankA) in Switzerland. FINMA had initially granted licenses to 2 additional companies, bringing the total to 6, but these were later revoked because the companies no longer met the regulatory requirements.

What may explain the low number of fintech licenses in Switzerland is the fact that public deposits accepted by these companies are not segregated in case of bankruptcy. FINMA is therefore cautious when granting licenses, as it seeks to prevent depositors from losing their funds in the event of a failure, which is a key aspect of depositor protection.

Another lesser-known reason is that FINMA applies the principle of consolidated supervision when it comes to groups of companies, which can significantly slow down the process or even make such supervision impractical (e.g., if other companies in the group are based in tropical islands with which Switzerland does not have an information exchange agreement). This is an issue we analyze early in the licensing process to ensure the smoothest possible process. A preliminary call with FINMA can also be an option.

Yes. Although English is not an official language in Switzerland, it is widely used in the financial sector. The entire application process can be conducted in English, and the required documents may be submitted in English. Most SROs provide English-language forms and are accustomed to reviewing documentation in English.

Generally, a fintech company can accept clients on a reverse solicitation basis, meaning the initiative must come exclusively from the client. However, it depends on the countries. Each jurisdiction may have different regulations. If the fintech company directly solicits clients, it must ensure compliance with cross-border regulations, including establishing a cross-border policy and obtaining the relevant country manuals. As a fintech company, the geographic scope of the company’s activities must also be defined in the Organizational Business Regulation (OBR).

Yes, an SRO member can apply for a FINMA license. Once obtained, the SRO membership becomes unnecessary, as all financial activities of the company, including AML compliance, fall under FINMA’s direct supervision. Effectively, the FINMA license replaces the SRO membership.

Do not hesitate to reach out. We’ll be happy to answer your questions and assess how we can best support you. Book a call now or email us at info@synhedge.com

Copyright © SynHedge LLC - 2026

Copyright © SynHedge LLC - 2026