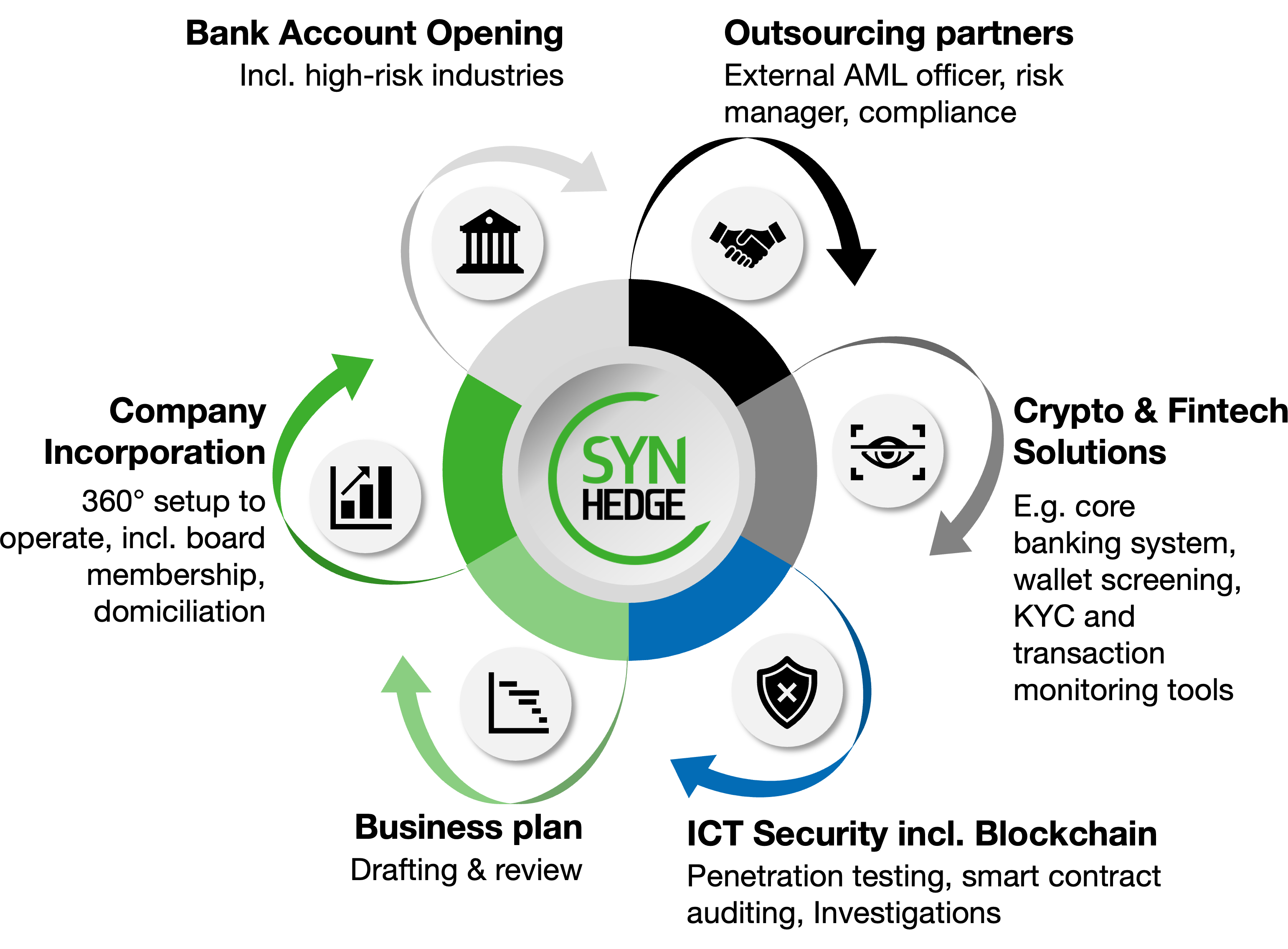

• Regulatory assessment (use of exemptions)

• Trusted Advisory Services

• Swiss Concierge

• Regulatory services (licensing)

• Asset management structure

• AML Support

• Trusted advisory services

• Facilitator Services

• Representation in negotiations

• Regulatory services

• SPV & Fund structure

• Support in crypto-assets investments

• Passion assets

Copyright © SynHedge LLC - 2026

Copyright © SynHedge LLC - 2026