At least two local executive directors and three board members. One-third of the board of directors must be independent from the management.

A fintech license, as defined under Article 1b of the Swiss Banking Act, formally person pursuant to Art. 1b Banking Act, is a "light" banking license granted by the Swiss Financial Market Supervisory Authority (FINMA).

This license allows for the conduct of most banking activities, excluding interests margin business, lending, asset management, and securities trading, with certain restrictions. Specifically, it permits the acceptance of client funds up to CHF 100 million, though many funds received may not count toward this limit depending on their origin (e.g., funds from corporates with professional treasury management).

This license is often compared to an EMI license in the UK or Europe, but it offers additional benefits. The Swiss fintech licence is more than a Swiss EMI licence. One of the key benefits is that a fintech company may open a sight deposit account with the Swiss National Bank (SNB), and directly access the payment system SIC (no intermediary bank is required). Another significant practical advantage is that the fintech license is regulated under the Banking Act (Art. 1b). This provides assurance, particularly in terms of working with major foreign correspondent banks, which can be a challenge for EMIs that are neither prudentially regulated nor governed by the Banking Act. This advantage instills a great deal of confidence among financial partners. Finally, another benefit is the ability to combine crypto, payment, and banking activities under a single license, which is quite exceptional.

More information can be found in our presentation below.

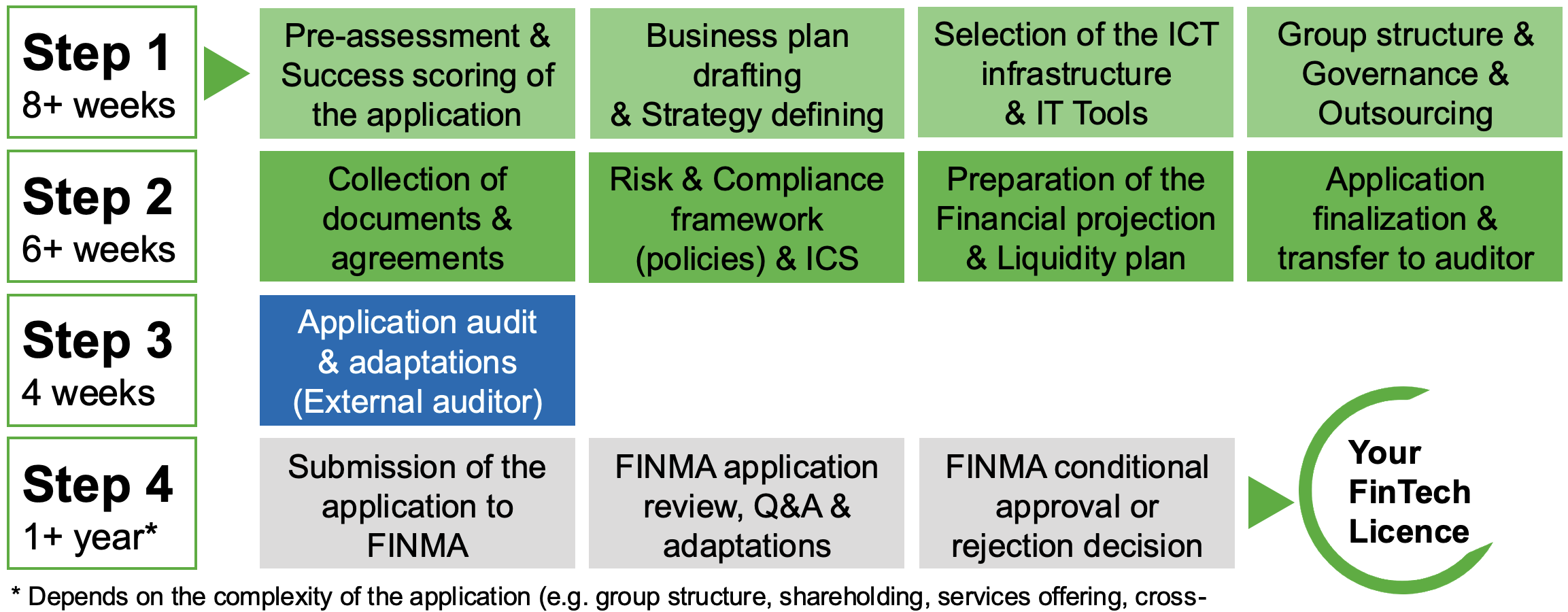

The process of obtaining a fintech license unfolds in 4 main phases.

Step 1 - Business plan:

Once your company is incorporated in Switzerland, the first step is to establish a solid business plan. This includes regulatory assessments of the planned activities, as well as the selection of IT tools and infrastructure (e.g., outsourcing, core banking systems, KYC tools, etc.).

Step 2 - Formal Application Process:

During this phase, we collect the personal documents of the directors, board members, and external service providers. We then establish the compliance and risk framework, which includes creating several policies, a risk register, etc. We base our approach on ISO 31000. Finally, financial projections are prepared, including three different scenarios.

Step 3 - External Audit:

Once all the documents are reviewed and collected, we submit the application to an external auditor who evaluates the entire application and prepares a report for FINMA. The audit must be conducted by an approved auditor (Art. 1b BankA).

Step 4 - FINMA Review & Decision:

Once the audit is successfully passed, we submit the application to FINMA, who will review it and may ask additional questions. Finally, FINMA will issue the authorization if all conditions are met. This is often a conditional authorization at first, allowing the applicant to address any specific conditions (such as a change of address or modification of the statutes). Once the conditions are fulfilled and FINMA gives its final approval, the applicant can activate the license and begin operations.

The duration of the fintech license application process with FINMA depends on several factors, including the business plan, the risks associated with the company, the compliance framework, whether consolidated supervision applies, and the responsiveness of the applicant. In practice, obtaining a fintech license now takes longer than it did initially, particularly due to the bankruptcy of two fintech companies (Mogeli & Swiss 4.0). As a result, FINMA has become more stringent in its financial and business plan assessments. To give an estimate, the process generally takes between one and two years.

The capital requirement for a fintech license is set at CHF 300,000 (fully paid). However, in practice, FINMA will require the company to have sufficient liquidity to cover all operational expenses for the next 12 months, based on a worst-case scenario. Generally, with a minimum structure, this leads to a capital of approximately CHF 1 million, although this depends on the company’s specific costs.

Yes, an SRO member can apply for a FINMA license. Once obtained, the SRO membership becomes unnecessary, as all financial activities of the company, including AML compliance, fall under FINMA’s direct supervision. Effectively, the FINMA license replaces the SRO membership.

As of April 4, 2025, there are only 4 companies active with a fintech license (1b bankA) in Switzerland. FINMA had initially granted licenses to 2 additional companies, bringing the total to 6, but these were later revoked because the companies no longer met the regulatory requirements.

What may explain the low number of fintech licenses in Switzerland is the fact that public deposits accepted by these companies are not segregated in case of bankruptcy. FINMA is therefore cautious when granting licenses, as it seeks to prevent depositors from losing their funds in the event of a failure, which is a key aspect of depositor protection.

Another lesser-known reason is that FINMA applies the principle of consolidated supervision when it comes to groups of companies, which can significantly slow down the process or even make such supervision impractical (e.g., if other companies in the group are based in tropical islands with which Switzerland does not have an information exchange agreement). This is an issue we analyze early in the licensing process to ensure the smoothest possible process. A preliminary call with FINMA can also be an option.

In general, a fintech company must have at least a board of directors composed of three members with sufficient experience and knowledge to oversee the business. Additionally, at least two executive directors are required. A clear separation between revenue-generating functions and risk/compliance functions must be maintained. In practice, this means having at least: i) A Chief Executive Officer, and ii) A Chief Risk Officer / Chief Compliance Officer

It is also recommended to have a Chief Operating Officer or Chief Technology Officer.

Finally, it is crucial for the company to have robust risk and compliance frameworks in place.

Generally, a fintech company can accept clients on a reverse solicitation basis, meaning the initiative must come exclusively from the client. However, it depends on the countries. Each jurisdiction may have different regulations. If the fintech company directly solicits clients, it must ensure compliance with cross-border regulations, including establishing a cross-border policy and obtaining the relevant country manuals. As a fintech company, the geographic scope of the company’s activities must also be defined in the Organizational Business Regulation (OBR).

Do not hesitate to reach out. We’ll be happy to answer your questions and assess how we can best support you. Book a call now or email us at info@synhedge.com

Copyright © SynHedge LLC - 2026

Copyright © SynHedge LLC - 2026