SynHedge will provide you with a comprehensive plan, including a detailed checklist and a project management process. In the meantime, you can already review the FINMA Website, which offer valuable information.

A portfolio manager licence is a licence issued by the Swiss Financial Market Supervisory Authority (FINMA) that all independent portfolio managers and trustees in Switzerland are required to obtain since 2020 in order to operate as financial intermediaries. Previously, they were regulated by self-regulatory organizations (SROs). Today, in addition to the FINMA license they must obtain, portfolio managers must be affiliated with a supervisory organization (SO) for ongoing supervision. Therefore, the Portfolio Manager License is a dual authorization issued by FINMA in conjunction with affiliation to a SO.

SO organizations supervise their members and ensure compliance with financial market laws, while FINMA remains responsible for granting licenses and holds the authority to take corrective actions and impose sanctions if financial institutions fail to comply with regulatory requirements.

This license enables the management of third-party client portfolios, and the provision of investment advisory services. Specifically, it authorizes the management of third-party funds based on a power of attorney, as well as investment funds under the "minimus" rules. This license is commonly referred to as an external asset management license or wealth management license.

A portfolio management licence enables you to conduct businesses such as:

• Portfolio Management: Allows the management of client funds with appropriate authorization and adherence to regulatory standards.

• Fund Management Under de minimis: Manage collective investment schemes under the de minimis regime, but only for qualified investors and within strict AUM and structural limits.

• Investment Advisory: Permits offering investment advice to clients.

• Management of Occupational Pension Schemes: If pension schemes limited to CHF 100m and no more than 20% or the assets of an individual occupational pension scheme in the mandatory segment.

• AMCs strategy management: Allows to define and manage the strategy of AMCs

• Additional Activities: This license also covers nearly all activities permissible under an SRO membership.

• Not sure whether this licence is the right for your business? Contact us and we will find out.

More information can be found in our presentation below.

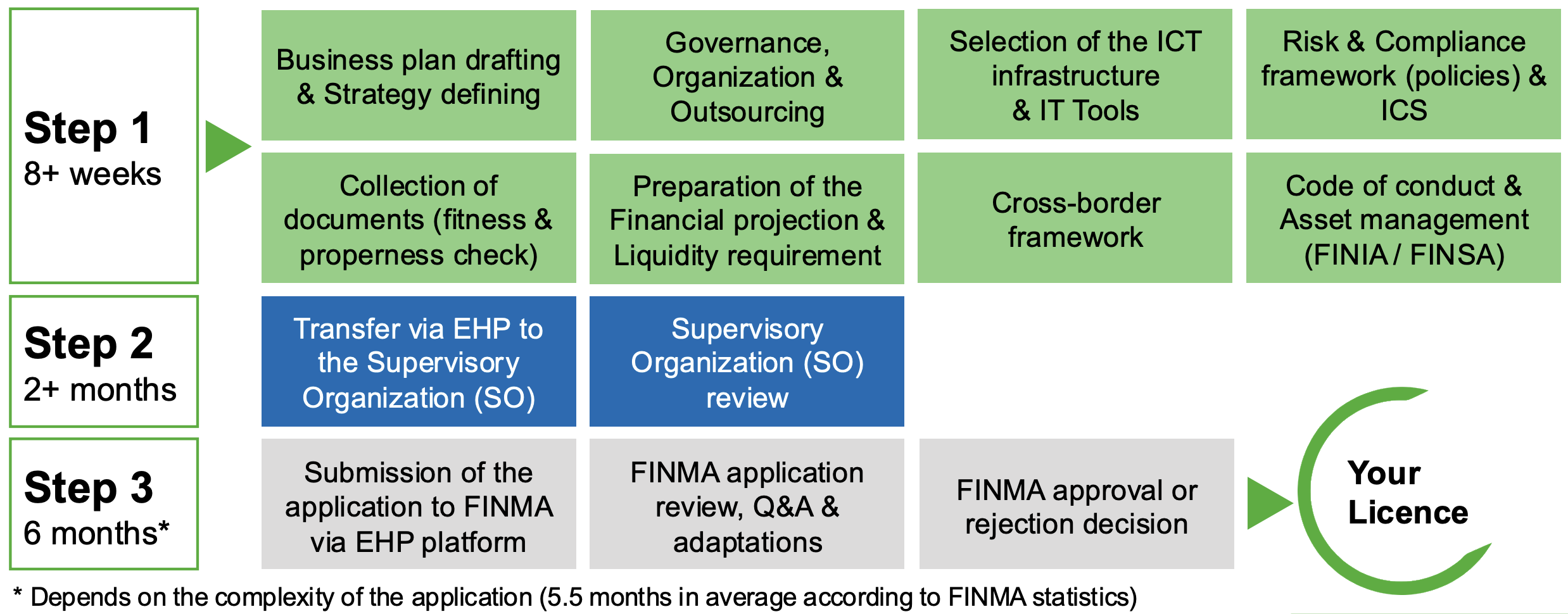

The licensing process for portfolio managers and trustees in Switzerland is conducted entirely online through FINMA’s EHP (survey and application platform) and involves five key steps:

Step 1: Application Preparation

The applicant must register on FINMA’s website to gain access to the EHP portal via two-factor authentication. The applicant completes the licence form available in the EHP system. Instructional videos and guidance materials are provided by FINMA.

Step 2: Submission to a Supervisory Organization (SO) & Review

The applicant must then choose a FINMA-authorized SO and submit their completed application through EHP. There are currently five SO authorized by FINMA to oversee portfolio managers in Switzerland: AOOA, SO-FIT, Fincontrol, OSFIT, and OSFIN. An updated list of authorized SOs is available on FINMA’s website. The SO reviews the application and issues an official confirmation of affiliation, which is required for the final step.

Step 3: Final Submission to FINMA

With the SO confirmation, the complete application is submitted to FINMA via EHP. FINMA may request additional documents if necessary. An overview of the licensing process of portfolio managers and trustees can be found on FINMA's website.

The duration of the portfolio license application process with FINMA depends on several factors, including the business plan, the risks associated with the company, the compliance framework, and the responsiveness of the applicant. In average it takes 5.5 months to obtain a licence once submitted to FINMA (FINMA's statistics).

Yes, an SRO member can apply for a FINMA license. Once obtained, the SRO membership becomes unnecessary, as all financial activities of the company, including AML compliance, fall under FINMA’s direct supervision. Effectively, the FINMA license replaces the SRO membership.

As a general rule, a minimum of two qualified managers domiciled in Switzerland is required. One qualified manager may be sufficient if the continuity of the business is ensured.

An internal auditor is mandatory for large portfolio managers. This requirement depends on factors such as the scope of activities, gross earnings, and number of full-time employees (FTE > 10).

As a principle, the risk management and compliance functions must be independent from any revenue-generating activities.

However, small portfolio managers may benefit from a relief if the following conditions are met:

• No increased risk profile

• Fewer than 5 full-time employees (FTE < 5)

• Gross earnings below CHF 2 million

Do not hesitate to reach out. We’ll be happy to answer your questions and assess how we can best support you. Send us your request.

Copyright © SynHedge LLC - 2026

Copyright © SynHedge LLC - 2026